A Navy Federal check deposit ATM is an automated teller machine (ATM) that allows Navy Federal Credit Union (NFCU) members to deposit checks into their accounts without having to go into a branch. This can be a convenient option for members who are on the go or who do not have time to visit a branch during regular business hours.

Navy Federal check deposit ATMs are available at a variety of locations, including grocery stores, pharmacies, and shopping malls. They are typically easy to use and only require a few simple steps. Members simply insert their NFCU debit card into the ATM, select the "deposit check" option, and follow the prompts on the screen. The ATM will scan the check and deposit the funds into the member's account.

There are several benefits to using a Navy Federal check deposit ATM. First, it is a convenient way to deposit checks without having to go into a branch. Second, it is a safe and secure way to deposit checks. Third, it is a fast way to deposit checks. The funds are typically deposited into the member's account within 24 hours.

Navy Federal Check Deposit ATM

Navy Federal check deposit ATMs are a convenient and secure way to deposit checks without having to go into a branch. They are available at a variety of locations, including grocery stores, pharmacies, and shopping malls. To use a Navy Federal check deposit ATM, simply insert your NFCU debit card into the ATM, select the "deposit check" option, and follow the prompts on the screen. The ATM will scan the check and deposit the funds into your account.

- Convenience: Navy Federal check deposit ATMs are available at a variety of locations, making it easy to find one near you.

- Security: Navy Federal check deposit ATMs are safe and secure, using the latest technology to protect your information.

- Speed: Deposits made at a Navy Federal check deposit ATM are typically processed within 24 hours.

- Ease of use: Navy Federal check deposit ATMs are easy to use, with simple instructions on the screen.

- Availability: Navy Federal check deposit ATMs are available 24 hours a day, 7 days a week.

- No fees: Navy Federal does not charge any fees for using its check deposit ATMs.

- Support: Navy Federal offers 24/7 customer support for its check deposit ATMs.

Navy Federal check deposit ATMs are a valuable resource for NFCU members. They provide a convenient, secure, and fast way to deposit checks. With a variety of locations and 24/7 availability, Navy Federal check deposit ATMs are a great way to manage your finances on your own time.

1. Convenience

One of the key benefits of Navy Federal check deposit ATMs is their convenience. With a variety of locations, including grocery stores, pharmacies, and shopping malls, it is easy to find a Navy Federal check deposit ATM near you. This is especially important for members who are on the go or who do not have time to visit a branch during regular business hours.

The convenience of Navy Federal check deposit ATMs is also important for members who live in rural or underserved areas. These members may not have access to a physical branch, but they can still use a check deposit ATM to deposit checks and manage their finances.

The convenience of Navy Federal check deposit ATMs is a major reason why they are so popular with members. Members appreciate the ability to deposit checks quickly and easily, without having to go into a branch. This saves them time and hassle, and it makes it easier to manage their finances.

2. Security

When it comes to your finances, security is paramount. Navy Federal understands this, which is why our check deposit ATMs are equipped with the latest technology to protect your information.

- Encryption: All data transmitted between your card and the ATM is encrypted using industry-standard SSL technology. This ensures that your personal and financial information is protected from unauthorized access.

- Video surveillance: All Navy Federal check deposit ATMs are equipped with video surveillance cameras. This helps to deter crime and provides a record of any suspicious activity.

- 24/7 monitoring: Our check deposit ATMs are monitored 24/7 by our security team. This helps to ensure that any suspicious activity is detected and addressed quickly.

- Regular security updates: Our check deposit ATMs are regularly updated with the latest security patches and software updates. This helps to ensure that our ATMs are protected from the latest security threats.

By using a Navy Federal check deposit ATM, you can be confident that your information is safe and secure. Our ATMs are equipped with the latest technology to protect your data, and they are monitored 24/7 by our security team.

3. Speed

One of the key benefits of Navy Federal check deposit ATMs is their speed. Deposits made at a Navy Federal check deposit ATM are typically processed within 24 hours, which is much faster than traditional methods of depositing checks, such as mailing them in or taking them to a branch.

This speed is important for several reasons. First, it allows members to access their funds more quickly. This can be especially important for members who need to pay bills or make other financial transactions quickly.

Second, the speed of Navy Federal check deposit ATMs can help members to avoid late fees and other penalties. For example, if a member needs to make a rent payment, they can use a check deposit ATM to deposit their check and ensure that the payment is processed on time.

The speed of Navy Federal check deposit ATMs is also important for businesses. Businesses can use check deposit ATMs to deposit checks from customers and clients, and the funds will be available within 24 hours. This can help businesses to improve their cash flow and manage their finances more efficiently.

Overall, the speed of Navy Federal check deposit ATMs is a major benefit for members and businesses alike. Deposits made at a Navy Federal check deposit ATM are typically processed within 24 hours, which is much faster than traditional methods of depositing checks.

4. Ease of use

Navy Federal check deposit ATMs are designed to be easy to use, with simple instructions on the screen. This makes them ideal for members of all ages and technical abilities. Even if you have never used a check deposit ATM before, you should be able to use a Navy Federal check deposit ATM without any problems.

- Clear instructions: The instructions on the screen are clear and concise, making it easy to follow the steps necessary to deposit your check.

- User-friendly interface: The user interface is designed to be user-friendly, with large buttons and easy-to-read text.

- Variety of languages: The instructions are available in a variety of languages, making it easy for members of all backgrounds to use the ATMs.

- Help available: If you need help using the ATM, you can call the Navy Federal customer service number or visit the Navy Federal website.

The ease of use of Navy Federal check deposit ATMs is a major benefit for members. It makes it easy for members to deposit checks quickly and easily, without having to go into a branch. This saves them time and hassle, and it makes it easier to manage their finances.

5. Availability

The availability of Navy Federal check deposit ATMs 24 hours a day, 7 days a week is a major benefit for members. It allows members to deposit checks at their convenience, without having to worry about branch hours or holidays.

This availability is especially important for members who have busy schedules or who live in rural or underserved areas. These members may not have time to visit a branch during regular business hours, or they may not have access to a branch nearby.

The availability of Navy Federal check deposit ATMs 24 hours a day, 7 days a week also provides members with peace of mind. They know that they can deposit checks at any time, even if they have an unexpected financial need.

Overall, the availability of Navy Federal check deposit ATMs 24 hours a day, 7 days a week is a valuable benefit for members. It provides them with the convenience and flexibility they need to manage their finances.

6. No fees

Navy Federal's no-fee check deposit ATMs are a major benefit for members. Unlike many other banks and credit unions, Navy Federal does not charge any fees for using its check deposit ATMs. This can save members a significant amount of money over time, especially if they deposit checks frequently.

- Convenience: No-fee check deposit ATMs are convenient for members because they can deposit checks without having to go into a branch. This can save them time and hassle, and it can also be more convenient for members who live in rural or underserved areas.

- Accessibility: No-fee check deposit ATMs are accessible to all Navy Federal members, regardless of their account balance or membership status. This makes it easy for members to deposit checks, even if they do not have a lot of money in their account.

- Savings: No-fee check deposit ATMs can help members save money on banking fees. Many banks and credit unions charge fees for using their check deposit ATMs, but Navy Federal does not. This can save members a significant amount of money over time.

Overall, Navy Federal's no-fee check deposit ATMs are a valuable benefit for members. They provide members with a convenient, accessible, and affordable way to deposit checks. This can save members time, hassle, and money.

7. Support

Navy Federal's 24/7 customer support for its check deposit ATMs is a valuable service that provides members with peace of mind and assistance when they need it most. This support is available by phone, email, and chat, so members can get help with any issues they may encounter while using a check deposit ATM.

This support is especially important for members who are new to using check deposit ATMs or who have encountered problems in the past. The customer support team can help members troubleshoot any issues they are having and provide guidance on how to use the ATMs correctly. This can help members avoid frustration and ensure that their checks are deposited safely and securely.

In addition, the 24/7 customer support team can help members with other issues related to their Navy Federal accounts. For example, members can call the customer support team to report a lost or stolen debit card, inquire about their account balance, or get help with online banking. This comprehensive support helps members manage their finances and resolve any issues they may encounter.

Overall, Navy Federal's 24/7 customer support for its check deposit ATMs is a valuable service that provides members with peace of mind and assistance when they need it most. This support helps members use the check deposit ATMs safely and securely and resolve any issues they may encounter.

FAQs on Navy Federal Check Deposit ATMs

Navy Federal check deposit ATMs are a convenient and secure way to deposit checks without having to go into a branch. They are available at a variety of locations, including grocery stores, pharmacies, and shopping malls. To use a Navy Federal check deposit ATM, simply insert your NFCU debit card into the ATM, select the "deposit check" option, and follow the prompts on the screen. The ATM will scan the check and deposit the funds into your account.

Question 1: Are Navy Federal check deposit ATMs safe and secure?

Yes, Navy Federal check deposit ATMs are safe and secure. They use the latest technology to protect your information, and they are monitored 24/7 by our security team.

Question 2: How long does it take for checks to be deposited using a Navy Federal check deposit ATM?

Deposits made at a Navy Federal check deposit ATM are typically processed within 24 hours.

Question 3: Is there a fee to use a Navy Federal check deposit ATM?

No, Navy Federal does not charge any fees for using its check deposit ATMs.

Question 4: What should I do if I have trouble using a Navy Federal check deposit ATM?

If you have trouble using a Navy Federal check deposit ATM, you can call the Navy Federal customer service number or visit the Navy Federal website for assistance.

Question 5: Can I deposit cash using a Navy Federal check deposit ATM?

No, Navy Federal check deposit ATMs can only be used to deposit checks.

Question 6: What are the benefits of using a Navy Federal check deposit ATM?

There are many benefits to using a Navy Federal check deposit ATM, including convenience, security, speed, ease of use, availability, and no fees.

Summary: Navy Federal check deposit ATMs are a safe, secure, and convenient way to deposit checks. They are available 24/7, and there is no fee to use them. If you have any questions or concerns, you can call the Navy Federal customer service number or visit the Navy Federal website for assistance.

Transition to the next article section: If you are interested in learning more about the specific locations of Navy Federal check deposit ATMs, please visit the Navy Federal website.

Tips for Using Navy Federal Check Deposit ATMs

Navy Federal check deposit ATMs are a convenient and secure way to deposit checks without having to go into a branch. By following these tips, you can ensure that your checks are deposited safely and securely:

Tip 1: Endorse your checks before depositing them.

Endorsing your checks helps to prevent fraud and ensures that the checks can only be deposited into your account. To endorse a check, simply sign your name on the back of the check below the words "For Deposit Only".

Tip 2: Verify the amount of the check before depositing it.

Make sure that the amount of the check is correct before depositing it. You can do this by comparing the amount on the check to the amount on the deposit slip.

Tip 3: Keep your deposit slip for your records.

The deposit slip provides a record of your deposit. It is a good idea to keep your deposit slip for your records in case you need to track your deposit or if there is a problem with the deposit.

Tip 4: Deposit your checks promptly.

Depositing your checks promptly helps to prevent fraud and ensures that the checks are processed quickly. It is a good idea to deposit your checks within a few days of receiving them.

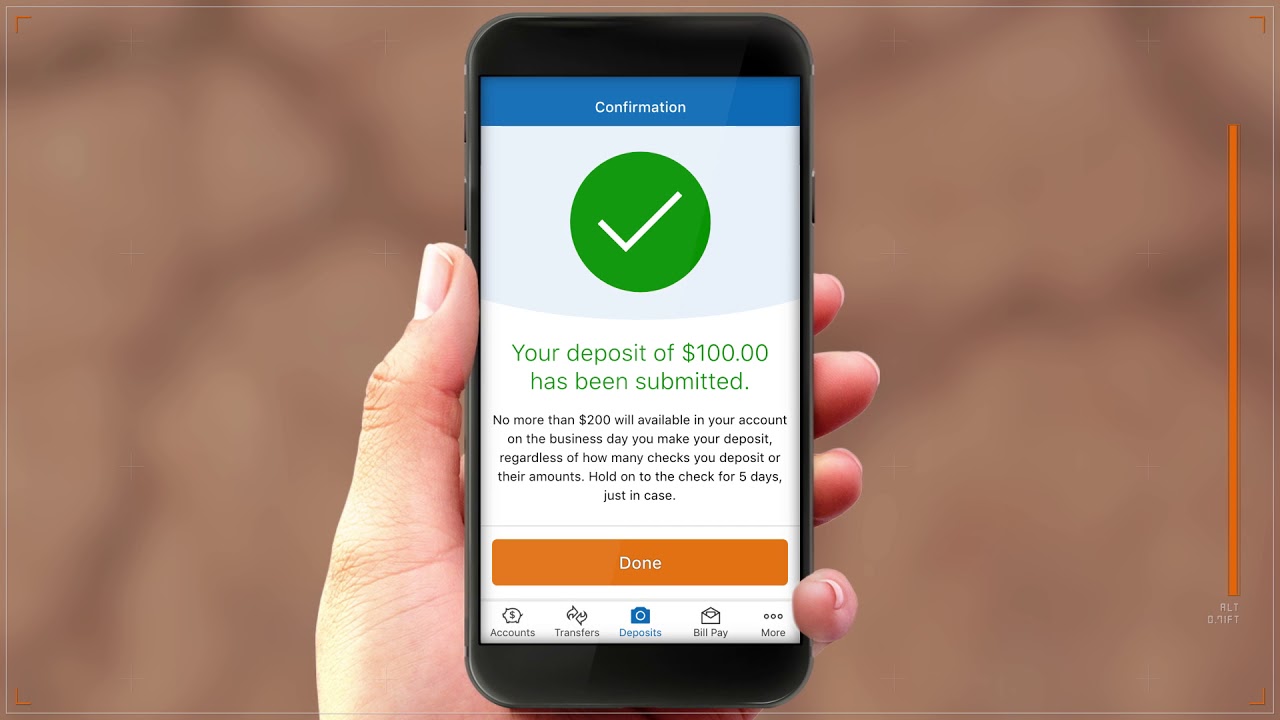

Tip 5: Be aware of the ATM's daily deposit limit.

Navy Federal check deposit ATMs have a daily deposit limit. This limit varies depending on the ATM, so it is important to be aware of the limit before making a deposit. You can find the daily deposit limit on the ATM screen.

Summary: By following these tips, you can ensure that your checks are deposited safely and securely using Navy Federal check deposit ATMs. These tips will help to prevent fraud, ensure that your checks are processed quickly, and provide you with peace of mind.

Transition to the article's conclusion: If you have any questions or concerns about using Navy Federal check deposit ATMs, please visit the Navy Federal website or call the Navy Federal customer service number.

Conclusion

Navy Federal check deposit ATMs are a convenient, secure, and efficient way to deposit checks. They are available 24/7, and there is no fee to use them. By following the tips outlined in this article, you can ensure that your checks are deposited safely and securely.

Navy Federal check deposit ATMs are a valuable resource for members. They provide a convenient and secure way to deposit checks, and they can help members save time and money. If you are not already using Navy Federal check deposit ATMs, we encourage you to start using them today.

You Might Also Like

Henry County HOA Board Ousted After VoteHow Long Do Refrigerators Typically Last: An In-Depth Guide

The Ultimate Guide To Carly Carrigan: Biography And Beyond

Discover The Latest Inventory At Jabaay Motors

Expert Home Warranty Plans: Your Key To Coverage

Article Recommendations